Paying in full eliminates the need to pay interest on the card, saving you money and simultaneously building your credit score. The minimum credit limit is 300, and some cardholders report having limits as high as 1,000. If you make your first six monthly payments on time, you may be eligible for a credit limit. Credit cards with cash back at many local businesses, no annual or international fees, high limits, and a mobile app that makes it easy to manage your money. Part of making on-time payments each month is paying the statement balance in full. The Indigo Mastercard for Less than Perfect Credit may give high credit limits to people with good-to-excellent credit, a lot of income, and relatively little debt. The Indigo card has an initial credit limit of 300 to 1,000. This means paying your balance on time every month is the best way to boost your credit score. Payment history is the single biggest impactor of the FICO credit scoring model. The other part is using the card responsibly. The Indigo Card reports to all three major credit bureaus – TransUnion, Equifax, and Experian – meaning exercising financial responsibility can pay dividends quickly.įinding a quality credit card, like the Indigo, is just one piece of the puzzle, however. Whether you are establishing it for the first time – or trying to recover from a bankruptcy, foreclosure, or another financial hit – finding a lender willing to extend credit is challenging.Ĭredit builder credit cards, like the Indigo Card, are vital lifelines in this credit journey. 13, 2023 3 min read Table of Contents Card perks Fees and limitations Comparable cards FAQs Indigo Mastercard /10 CNET Rating Learn More Intro Offer No current. Like the Milestone Card, Genesis Financial charges the annual fee upon card activation, meaning the starting credit limit runs between 201 and 300. This actual credit available may vary depending on the annual fee, however. The Indigo Mastercard has a 300 credit limit to start. The card charges an annual fee with a starting credit limit of at least 300 with a potential increase in as little as six months. Submit your task DoNotPay will deliver the request letter on your behalf.

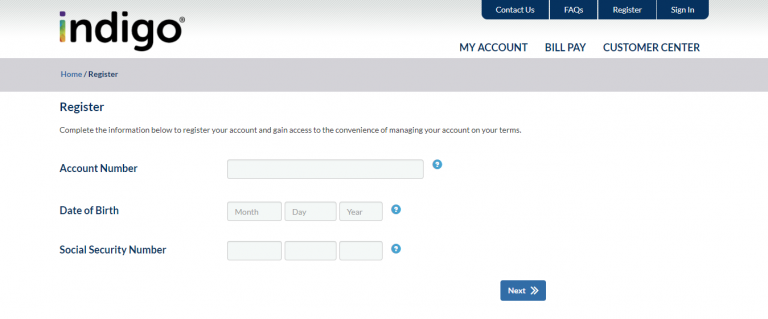

Upload a copy of your ID and provide your e-signature. Indicate whether you want to allow hard inquiries to be made into your credit history. The Indigo Mastercard Great for Building Creditīuilding credit is difficult. Once the annual fee is paid, the credit limit will return to 300. Tell us more about your current income and expenses and why you would like to request a limit increase.

0 kommentar(er)

0 kommentar(er)